Which Markets Are the Most And Least Served by Seed Investors?

About a year ago, my partner David Beisel talked about how seed fundraising is no longer a local game, and that the best entrepreneurs seek out the best investors for them outside of their home market. That being said, it’s much easier to put a seed round together when you have a local lead who can help catalyze the round. So much of seed investing is about the team, and it’s just much easier to build conviction around a team when you can meet at moment’s notice and spend time together in-person.

As a firm that has a thematic focus and is comfortable investing nationally, we routinely think about how to best allocate our time physically across multiple markets.

Anecdotally we’ve heard the sentiment that there are still very few firms who can lead seed rounds in New York, while we’ve also seen a recent uptick of Boston seed rounds led by non-Boston firms. To better understand the dynamics across different markets, I looked through some data and attempted to answer the following question – Which markets are the most and least served by seed investors who lead?

For this analysis, I focused on the four largest startup ecosystems in the U.S. – SF/Bay Area, New York, Boston, and LA.

A note on methodology: [For the amount of available lead seed dollars in each market, I only included seed firms who have at least led three seed rounds in the last 18 months, based on Crunchbase data. This is not the perfect data set as most seed rounds are either not announced at all or announced much later, but should be good enough to identify firms that consistently lead. There are a good number of seed firms (e.g. NextView, First Round, Collaborative Fund, Founder Collective, etc.) that have at least one full-time partner based in a “non-HQ market” and lead significant amount of deals in such market. For these firms, I allocated 40% of the fund dollars to that secondary home market. Lastly, given that we’re focused on the seed dollars available, I only included each firm’s main vehicle and did not include any opportunity fund.]

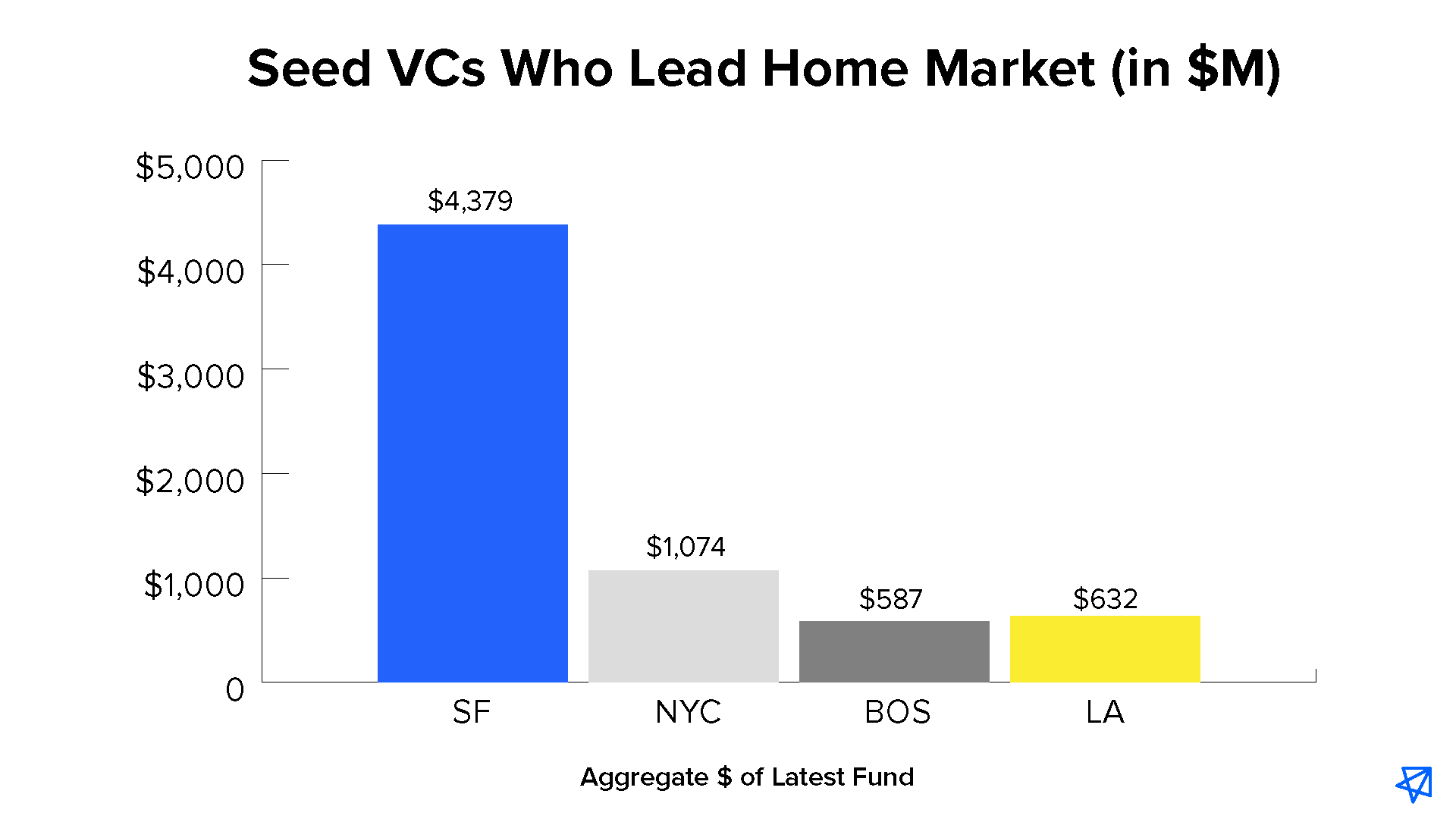

I aggregated each firm’s latest announced fund by home market to get a sense of available lead seed dollars of each market. Not surprisingly, SF leads the other three markets by a wide margin.

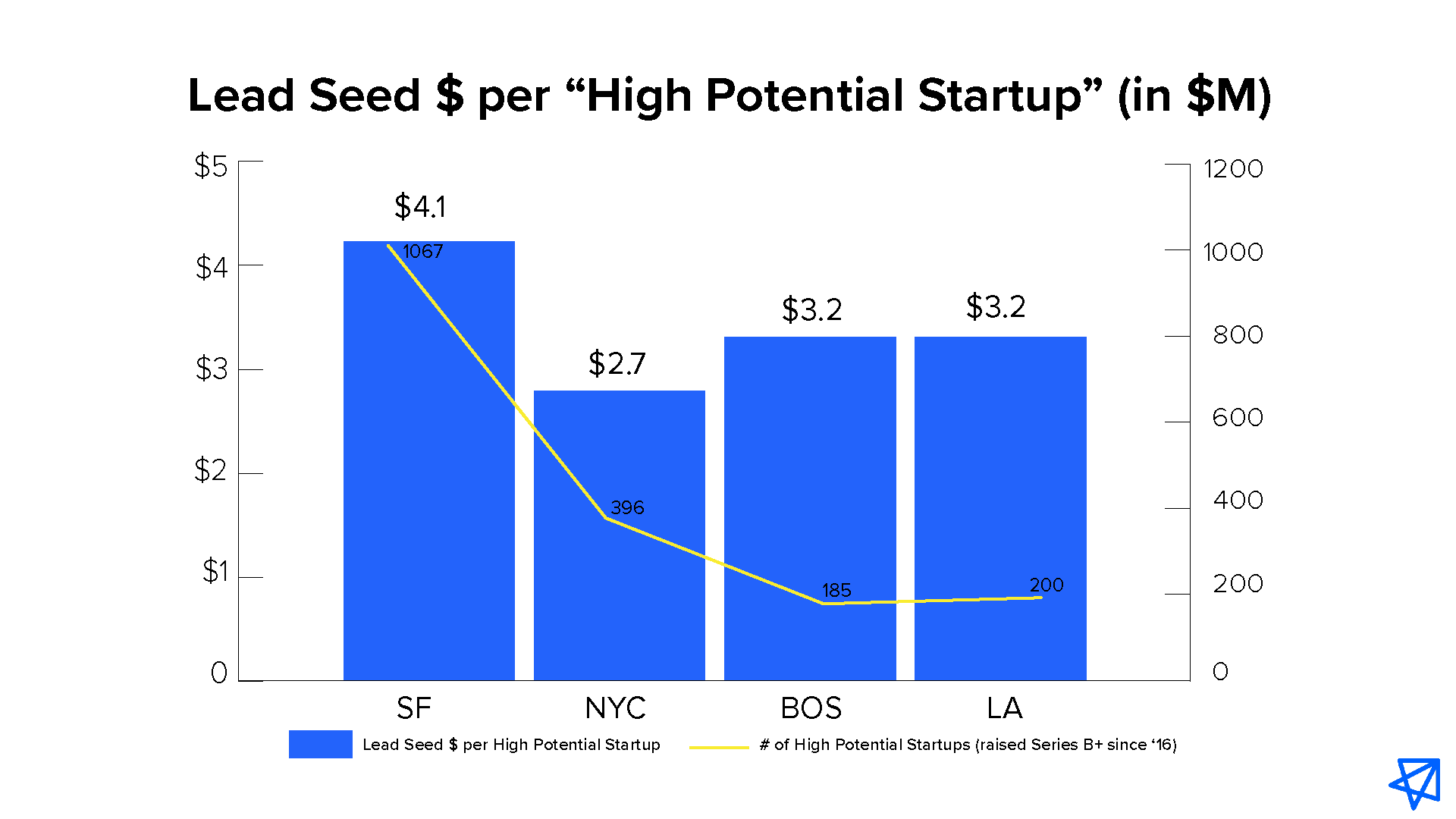

Next, we want to get a sense of the opportunity set in each market from the perspective of a seed investor. One way to think about this is how many high potential startups are in each market that have a chance of becoming a significant company and driving outsized return.

Instead of looking at exit value (which is a result of a seed investment done 7-10+ years prior and thus does not reflect the current state of each market), latest valuation (not wildly available and has similar lagging issues as exit value), or total amount raised (unfairly penalizes capital efficient business), I decided to use funding stage as a proxy.

I actually think having a recency bias here is important, as I’ve personally witnessed how an ecosystem with a strong growth momentum can change significantly in 10 years like New York has.

Using Crunchbase data, I pulled the number of companies in each market that have raised at least a Series B since 2016 (excluding any biotech companies) as a proxy for “High Potential Startups”. I chose Series B as the threshold because anecdotally that is the hardest round to raise.

It also strikes a good balance of being a meaningful signal of company potential without being too much of a lagging indicator. I also looked at using Series C as a threshold and the conclusion is basically the same.

Now comes the interesting part – how about the available lead seed dollars per “High Potential Startup”? As you can see from the chart below, New York actually has the least amount of lead seed dollars available, while Boston and LA are also quite underserved.

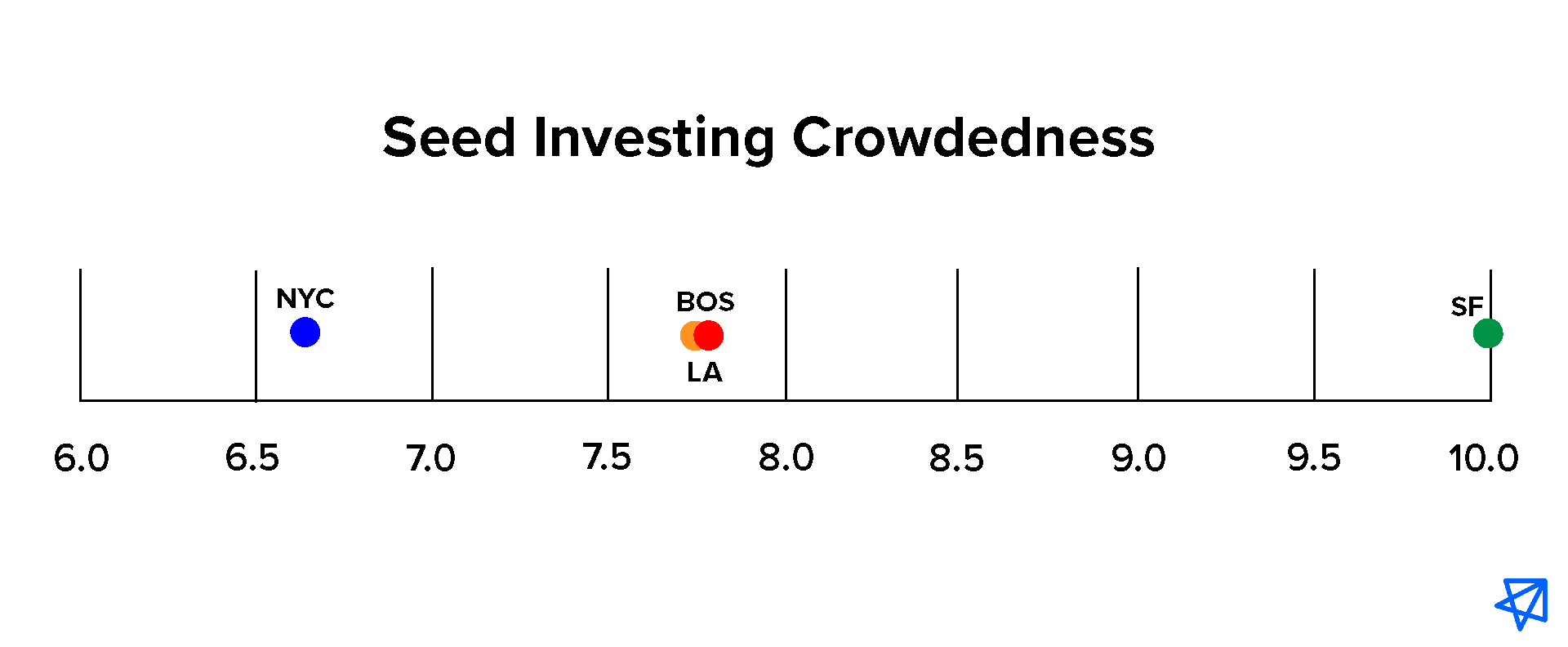

To frame it another way and consider whether a given market is relatively crowded or underserved by seed investors, I looked at the lead seed dollars per high potential startup for all the other markets relative to SF and normalized the data on a scale of 1-10 (with SF being a 10, i.e. most crowded), which resulted in the “seed investing crowdedness” ratio below.

Unsurprisingly, this analysis confirmed that the Bay Area has far more seed VC dollars that can lead rounds than the other major markets. However, looking at lead seed dollars relative to the volume of high-potential companies yielded some surprising results.

The wide gap between NYC and SF was particular surprising. Even though New York has the second most high-potential startups and the second most lead seed dollars, it seems significantly underserved relative to the other markets. This was a pleasant surprise for me given that I’m based in New York and our firm has been increasing our focus on this market in recent years.

I also think the Boston numbers reflect a sneaky reality that there are more under-the-radar good companies in this market than people realize.

Even though the relative shortage of seed firms who lead rounds in NYC represents a near-term opportunity for firms like ours, I do hope that there will be more local lead investors in this market as the ecosystem continues to develop and mature.

It’s exciting that there are a number of new seed firms that have emerged in New York over the past few years, and some of them could get comfortable leading rounds more often as they become more established. At the same time, the number of scaling companies also seem to be accelerating, so maybe the ratio will improve, maybe it won’t.

New York can always benefit from more hands-on, high-conviction seed investors who are not afraid to lead rounds pre-traction and work with founders shoulder-by-shoulder through the company building journey.