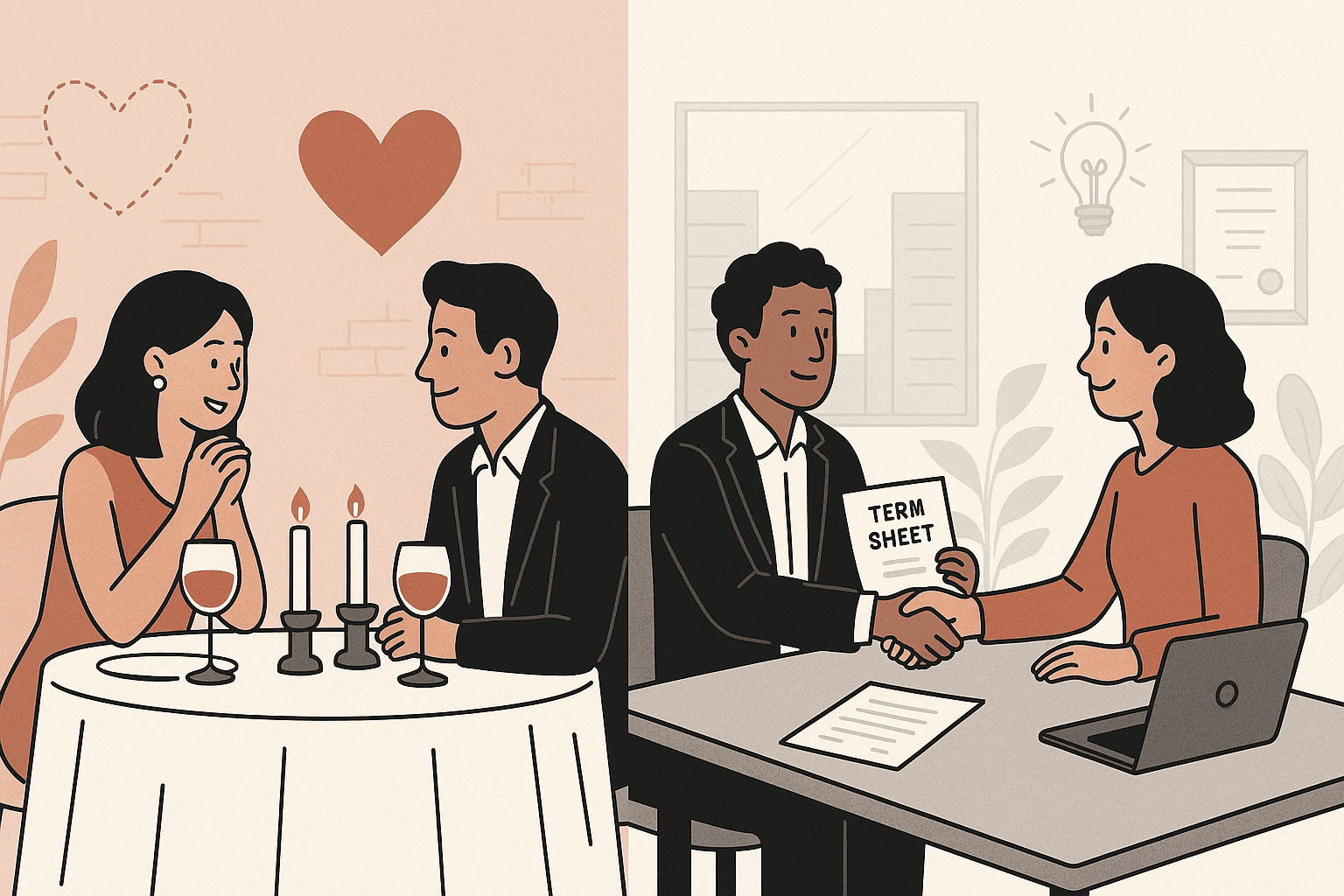

Choosing a VC Is Like Marriage But Pitching VCs is Not Like Dating

There is a well-known trope that as a founder, choosing a VC to partner with is like marriage. This is true. It’s a super important, near permanent relationship, especially for a lead investor who is likely to take a board seat for many years.

But in my experience, the metaphor ends there.

Extending the metaphor might suggest that pitching VCs is like dating. That is not true, and expecting it to be true doesn’t help anyone.

In dating, one hopes that their experience with another person is a decent indicator of what the future holds for marriage. But in VC that is only sometimes true, and often is a false indicator. I know many VCs who are amazing partners to founders through thick and thin. However, their reputation with founders who pitch them and don’t get an investment is mixed. Conversely, it’s common for investors to seem wonderful to work with when they are trying to access to a deal, but then act totally differently once they are on board. There are a couple reasons for this.

First, unlike in monogamous dating, a VC is already an investor in multiple companies when they are considering an investment in a new startup. Time is an investor’s scarce resource, and by definition, that time needs to be split between supporting existing portfolio companies and meeting with new founders. These two priorities can be at odds. From a dating/marriage standpoint, it’s like an investor has multiple spouses vying for their attention while they also have to then spend time dating other prospective spouses. If an investor chooses to over-index on being a great spouse, they then need to get more done with less time with prospective future spouses. This is why some of the best investors are tough to schedule with, seem rushed or distracted during a meeting, or aren’t always great at follow-up or feedback. I am not saying that disrespectful behavior should be forgiven, but I am saying that there is an indirect link between what an investor is like to work with at the pitching stage and how they are to work with post-investment.

Second, investors pursuing competitive deals will roll out the red carpet when they’re trying to win. This is especially true if a firm feels insecure about their market position relative to competitors. They’ll be more likely to make big promises, work disproportionately hard in the near term to “win” the deal, and will be more lax on diligence. Conversely, it’s possible that a better investor will not feel the need to act as frantically, and may probe more aggressively during the diligence process or be more deliberate about their decision-making. This better investor might more deeply appreciate the long-term commitment of being a great board member through thick and thin, and will want to do the work up front to build conviction and a real relationship with a founder. Founders may perceive this to be more troublesome during the “dating phase” but it may be the foundation of a better relationship once they are “married.”

So, if pitching a VC isn’t really like dating, how is a founder supposed to figure out who the right person is to work with? The obvious answer is good backchannel references. The number one advantage of the founder/VC relationship over a dating/marriage relationship is the ability to do multiple references. You probably can’t get good references from someone’s past partners, but you can get multiple references from founders who an investor has previously worked with. You can even seek out founders who can talk about how the investor acted when things went badly! It’s an amazing luxury to be able to make these calls, and what they tell you will be much more important than whatever impression you may have received on a first date.

That said, it’s hard to get the whole truth during these calls. Founders giving a reference on an investor might hesitate to be fully transparent because there is little upside from their perspective. So, I think one needs to carefully parse the feedback. You are looking for extremes. Are you hearing superlative feedback? Or are you hearing hesitancy in recommending the investor? You should assume that the starting point for most reference calls is probably a B+ or an A-. If you hear words that suggest that the investor is an A or A+, really pay attention. If you hear words that suggest that the investor is a B or B-, consider that a red flag.

Again, the point of this post is not to make excuses for the way VCs interact with founders they are getting to know. We are all professionals and valuable humans, and it’s important to treat everyone with ample respect. But because choosing an investor is like getting married, it’s important to pay attention to the signals that matter and to discount the ones that don’t.