Second Order Effects of a Bank Run On Fintech Startups

Now that the dust has settled after the SVB bank run and they have found a home at First Citizens Bank, it is worth taking a step back to understand the second-order implications on fintech startups.

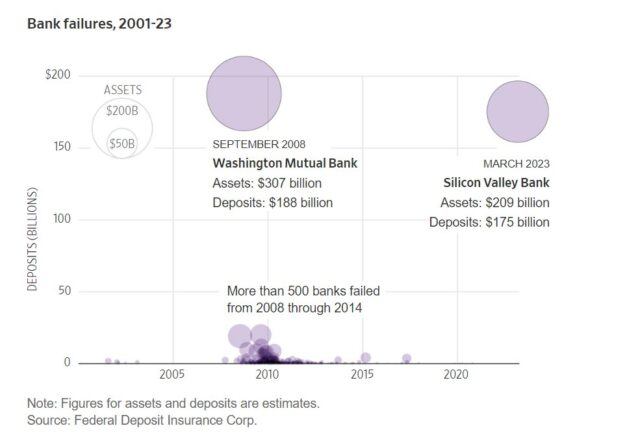

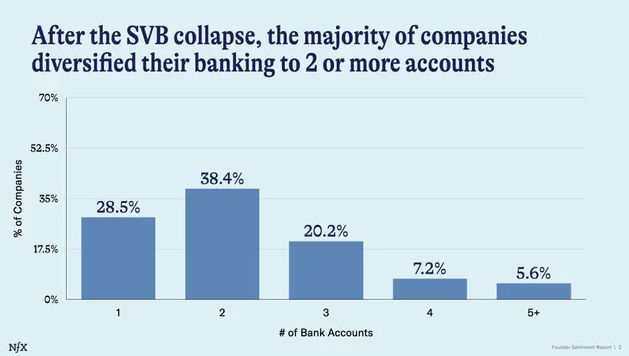

The first-order effects have been clear. SVB lost $42bn of deposits on Thursday, March 9th, in a “Twitter-fueled bank run.” Founders, VCs, and others pulled cash at a speed not seen before due to the speed at which information and money can move with modern technology. Thankfully, the government stepped in and backstopped deposits. Startups as a whole are opening multiple bank accounts to protect their cash.

So far, the contagion has spread to First Republic amongst other banks, most notably leading to UBS acquiring Credit Suisse. As second-order implications play out, a few things have come to light for fintech startups.

B2B Digital Banks

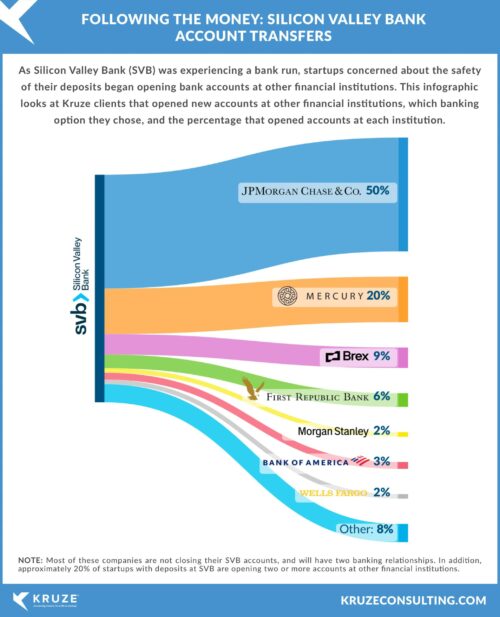

Post-SVB bank run, businesses flocked to banks perceived as more secure. B2B digital banks are the first to report the influx of deposits, largely because they can open accounts in a matter of hours versus a week.

Digital banks are more nimble and can offer customers more topical and tailored experiences than big banks. This will shore up customers’ confidence in the security of their deposits. So far, there have been three areas of focus for these startups.

- Increasing FDIC insurance through sweep programs

- Offering alternative stores of cash, i.e., money market funds

- Being transparent about portfolio strategy and management of duration risk

The big winners are Mercury and Brex. Mercury reported adding more than $2bn in deposits and thousands of new customers in the recent flurry. Brex added 3,000 new customers and took in billions of deposits, driven by the exodus from SVB. However, now that these startups have seen massive inflows, how do they keep these dollars? Do they lean even heavier into the safety of deposits?

B2B digital banks are already leaning harder into protecting consumer deposits. Brex rolled out their Business Account with up to $2.25M FDIC insurance using multiple partner banks and later bumped it to $6M. Mercury Vault marketed $3M of FDIC insurance and has since increased it to $5M using partner banks.

Fintech Infrastructure

If this is the start of a larger consolidation of banks, this could be a net negative for fintech infrastructure startups. These startups serve the unbundling of the bank and benefit from the fragmentation of the banking world. If there is a flight to safety, it would decrease the market opportunity.

However, in the near term, they are likely to benefit. There is an opportunity for fintech infrastructure startups to increase the adoption of embedded features that boost confidence in deposit products, such as Unit’s sweep program, Cambr, and Atomic’s treasury product.

KYC startups will gain traction as many new account openings require their services. Alloy saw select SMB clients experience significant spikes in account signups, sometimes increasing volume over 10x, according to the Head of Fintech, Charley Ma.

The founder of a KYB (know your business) startup has seen an increase in interest to help clear the backlog of new account openings.

For most traditional banks, the business account opening process was typically 2-3 weeks. Post-SVB bank run, it has dropped to 2-3 days, or even 2-3 hours if you know the right person. Some fintech startups and non-banks have pushed certain KYB requirements into the post-onboarding process to keep up with the exponential increase in demand.

Startups that offer KYB services, like Middesk and Persona are positioned to benefit from this tailwind.

Accurately pricing duration risk is (now obviously) very important, which SVB failed to do. Community banks could start to feel pain in their fixed-income holdings as well. Startups like Decameron help price fixed-income risk and mitigate potential losses (read more about how here).

Venture Debt

SVB is synonymous with venture debt and was arguably the most well-known for lending to tech startups. They aren’t necessarily the largest originator today but are a trailblazer for the product.

There was one caveat, though. SVB required a borrower to exclusively bank with them to access their venture debt product. This was likely necessary a decade ago, as having transparent insight into a company’s financials will help with underwriting and getting ahead of potential issues. Startups and VCs are unlikely to be as amenable to this requirement. Open banking has turned this on its head. Customers of non-bank lenders can bank elsewhere and still borrow. Financial information can be pulled using products like Railz and upSWOT to provide transparency to the lender for underwriting.

Sponsor banks

Despite not being fintech startups, sponsor banks could also suffer from collateral damage. There was already scrutiny from the OCC around their oversight into the compliance of the fintech startups they are partnered with. Some banks that just saw a large influx of deposits may also need to deal with the added complexity of staying below the $10bn AUM Durbin Amendment limit. This could become a balancing act for them to stay out of the crosshairs of the regulators and optimize for revenue in an increasingly competitive and now volatile market.