The Atomization of Seed Venture Capital Rounds

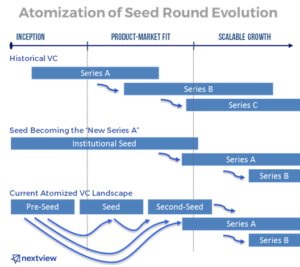

When we first started NextView Ventures in 2010, we did so because we recognized that there was an underserved need for seed-stage capital particularly along the east coast between Boston and New York. And during that time, the venture market has evolved to a point where “Seed is the New Series A.” However, not only has the Seed round established itself as the first round of institutional capital prior to product-market fit, but recently it’s being smashed into pieces… into little atoms… the sizes and shapes of which each look and feel different from each other. My plan in this extended post is to explain of why this atomization is happening, share a roadmap for entrepreneurs and VCs to navigate this landscape in flux, and identify where I believe there are currently unique opportunities for founders, other VCs, and NextView.

My partner Rob Go previously wrote a detailed post on the reasons on why Seed has become the institutional venture capital financing prior to product-market fit. This dynamic has happened due to a number of converging trends: capital efficiency allowing founders to get further with less, some institutional seed rounds getting bigger, the bifurcation of seed VCs with some funds deliberately investing later while others going even earlier to do pre-seeds. In addition, Series As are getting bigger on average and very divergent overall. Most (but of course not all) internet-enabled startups typically raise some type of seed capital before eventually raising a round traditionally called a Series A.

But something else is happening which hasn’t been talked about as much.

The Seed round itself has been fractured into smaller parts to be re-assembled in a bespoke fashion for each company.

Said another way, we’ve seen an atomization of seed.

The cause of this trend sits at the intersection of two seemingly divergent factors:

1. Increased startup capital efficiency

Founders can prove out early milestones — even important incremental ones — with small amounts of capital. It used to be that each step for increasing a startup’s value were large ones: a series of elephant-sized customer wins, a monumental product shipment, or a huge new partnership. But now these value-steps have become more graduated: SaaS revenue building over time, progression along iterative product roadmap, or a string of API integrations. This series of small successive wins propels a startup forward continuously. Rather than a staircase of building value, the startup milestones have become an escalator.

2. Series As are nearly all post-traction.

When I started in venture a decade ago, Series A financings were much more about team, market, product vision… and often were before product-market fit. Since that time, an influx of capital dedicated to the seed stage has entered into the market from angels, superangels, seed funds, crowdfunding, etc. This situation has increased the number of seed-stage startups in the ecosystem, empowering traditional Series A firms to become more selective and require more proven traction before investing (along with a commensurately higher price for that de-risking). Today almost all Series As are post-product-market-fit and post-traction, with the intention of using that capital to fuel growth. Just five years ago, VCs were prescribing that “your next most important milestone [after a Series A financing] will be ship the product and get enough customers using the product to start to demonstrate evidence that you have product/market fit.” Fastforward to today, and even $100K in monthly recurring revenue for a SaaS business isn’t always a sufficient condition for raising a Series A round. The threshold for what constitutes a Series A ready company has shifted dramatically as traditional VC firms are requiring an increasingly greater level of traction.

Here is what happens at the intersection of these two realities: At the very same time, entrepreneurs can do more with less capital but are also required to do more to raise it.

This confluence has resulted in entrepreneurs choosing (and sometimes being forced to) raise incremental stages of seed capital to successfully cross the Series A threshold. Raise a pre-seed round then a second-seed round, or raise an institutional seed round then a seed extension, or raise a series of incremental notes at higher implied valuations, or follow some other path entirely.

The graph below illustrates what has been and is now happening. In short, the startup path towards a Series A is no longer a linear one.

Some might lament this shifting of the Series A bar could be seen as a harbinger of trouble for startups. However, the ability for many of these very same companies to be able to raise additional incremental amounts of capital to prove out real successive milestones in reality unshackles them from the linear up-or-out framework of the past. Plug-in monetization platforms for both consumer and B2B business means that, if made a priority, revenue metrics earlier in the life of company can yield tangible real proofpoints for existing and prospective new investors. And the lean-startup approach with founding teams that are measured about their initial burn rate means that incremental rounds of capital won’t derail the progress which is being made.

Founders should think about “seed” not as one round, but as a stage that can encompass a couple of financings.

Specifically, what we’ve seen emerge beyond the classic seed round are both “pre-seeds” earliest in a life of a company and “second seeds” after an initial seed round has already been raised.

Pre-seeds have appeared as a distinct subcategory in this atomization, and earlier this year we as a team at NextView wrote a couple blog posts to define,explain how we think about them, and show some examples of how we participate in this so-called pre-seed stage. In fact, since those posts just a few months ago, we’ve made two new pre-seed investments. For founders, raising a pre-seed round can attract more sophisticated investors earlier in the life of the company, minimize the net dilution vis-à-vis raising a large seed round immediately, and set the stage for a successive larger round of financing if things begin to work quickly.

On the other end of the spectrum are seed extensions, post-seed, second seed, or recently dubbed runway seeds.

Now is a moment in time where we see a unique opportunity for second-seed rounds being particularly attractive, especially for B2B SaaS companies, both for us at NextView and for entrepreneurs alike.

The reasons for this situation are threefold, one related to scale, one multiples, and one expediency. On scale, my partner Lee has blogged in the past about how revenue = product market fit:

“[Revenue] is the best signal of product-market fit for B2B startups… If a business customer is willing to pay something for your early product, even nominal or beta pricing, that’s a pretty healthy indicator the product has value in terms of features and functionality.”

Generating $100K in revenue monthly recurring revenue surely signals confidence in in strong product-market fit… yet somehow the current early stage Series A market isn’t rewarding it fully… this gap is an opportunity.

The second aspect of the current landscape making second-seed startup financings attractive, for B2B software companies in particular, is the prevailing public market multiples which have translated into the private markets. Others have blogged about how the past two years we’ve witnessed a dramatic compression… up to 57% drop in forward revenue multiples. The best entrepreneurs have observed the same phenomenon, of course, and they realize that the best time to raise large amounts of capital isn’t when it’s expensive but rather than when it’s cheap, and vis-versa. Simple economic math prescribes entrepreneurs should raise big rounds when capital is plentiful and inexpensive, and instead raise milestone-driven capital when the capital comes with greater costs.

Thirdly, there is benefit to the potential speed of fundraising for a second seed. In many cases, the raising a smaller amount sooner is preferential to a long drawn out process for a classic Series A. This expediency might not be true in all of the time, but on the whole a second seed will be less consuming, and it’s a distinct strategy advantage for companies that might take a longer time with an involved process to raise a large A.

So it’s time to lose the baggage with the term “seed extension,” as it connotes that something isn’t working. In 2016, a B2B SaaS second seed isn’t an extension of last resort of failed Series A fundraising efforts, but rather a deliberate approach which optimizes the current reality.

Whether it’s in conjunction with an early pre-seed or later second-seed round of financing, the atomization of seed round capital means previous stigma surrounding around another seed round financing is significantly diminished or even gone. The real questions for startups remains the same: how much capital should the company raise now to prove out additional value-inflection milestones (regardless of label)?

For my colleagues and me at NextView, our broader and enduring mission at is to invest across the seed stage, and includes being opportunistic in all sub-segments regardless of the nomenclature of the day. Given our right-sized fund where both the pre-seeds “matter” to us, but we have the ample capacity to catalyze and lead larger multimillion second seeds in revenue-generated B2B startups, the entire seed stage area where we have been investing from the inception of our firm. We are excited by companies where the founders have become only more bullish about their market opportunity and product, but see value in investing more aggressively in product and sales efforts now before raising a full-blown series A.

The atomization of the seed stage landscape has in many cases made the path towards a Series A for startups a muddy one. However, it has also created a situation where the excesses of overcapitalization of companies seen in the later stages isn’t nearly as prevalent. Atomization means that incremental capital with incremental milestones further aligns entrepreneurs and investors to concentrate on the important items which need to be accomplished, all without significant time and capital at risk. The landscape is surely shifting, but those changes create opportunities for everyone paying attention to the changes.

This article originally appeared on my blog, GenuineVC, in a series of two posts.