Mega-Funds and the Great Re-Risking

I’ve had quite a few conversations about the changing risk dynamics of startups, especially as it relates to the activity of large mega-funds. In recent years, the majority of LP dollars flowing into VC have been going to a handful of huge funds. This has major implications on risk.

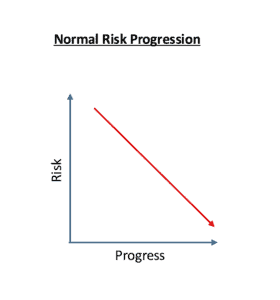

Normally, a startup has maximum risk early in its life before PMF. As the company makes progress, it moves down the risk curve.

This is overly simplified, but let’s just say it’s a linear decline like this:

Raising VC dollars both increases and decreases risk. Risk decreases because you have more resources and can accomplish things to improve your team, product, GTM, defensibility, etc. Risk increases because of a bigger preference stack, greater expectations, higher burn, etc.

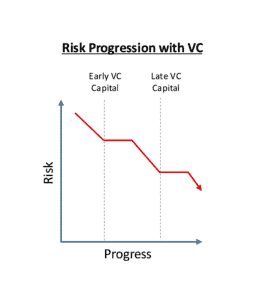

Typically, you think of a Series A startup as less risky than a seed startup, and a Series D startup as less risky than a Series A startup. This is often true, but because VC dollars both add and remove risk, the move down the risk curve is less linear. It’s something like this:

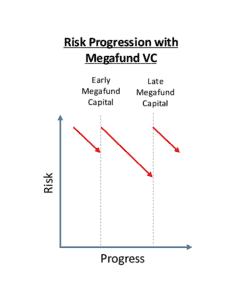

But in recent years, this picture has been skewed even more, especially if the capital raised comes from a mega VC fund. Instead of a steady or bumpy move down the risk curve, you have something more like this:

At each funding round, there is a significant re-risking of the startup, to the point that you are not moving meaningfully down the risk curve for a long, long time. And even at a late stage, a mega funding round can bring you right back up to the point of maximum risk.

Why is this happening? I think it comes down to two things that feed upon one another:

- Lower cost of capital

- Religious zeal about power-law outcomes

Combined, these create a massive incentive to accept increased risk for the hope of greater potential outcomes.

Lower Cost of Capital

Typically, the expected return for VC is quite high. It’s a long-dated asset class with limited liquidity. Investors are buying minority positions in the highest risk companies. The return better be worth it! But as huge pools of capital have sought to get exposure to US tech and innovation, these return expectations have changed. Because of the scale of these deployments, these LPs are willing to accept a lower rate of return in order to get a piece of the action.

Power-Laws

Power-laws have always driven venture capital. But as the economy has grown and technology has advanced, this has only become more and more true. This has also become a consensus opinion at all stages of venture investing. There is almost a religious zeal about it.

There used to be a bit more debate about power law dynamics. And the dynamic used to be different for early stage and late stage. But now, all venture investors at all stages are basically swinging for grand slams at every investment.

So, if an investor’s cost of capital is lower and belief about the power law is greater, risk tolerance increases significantly. Often this means investing way too much money at way too high of a price and increasing burn to chase way too speculative of a goal.

Mega-funds are less excited about a Series C with the potential of a 4X with minimal risk. Instead, shoot for a 20X even if doing so significantly increases risk. So what if doing this kills an otherwise promising company? There are other shots on goal with power law potential.

This is a tough deal for founders and employees. They only get one shot on goal, and a limited number of decades to try to build an enduring company that serves their customers well. This is a tough deal for smaller funds too. We take on significant risk early and have high return expectations from our LPs. We hope to be moving down the risk curve as companies make progress, not assuming more risk while also getting more diluted.

Unfortunately, I think founders, employees, and seed investors tend to think that mega VC rounds de-risk their equity. But instead, it’s the opposite. These rounds are a major re-risking.

So, is this re-risking really worth it? I think most of the time, the answer is “no.”