The Next Chapter for NextView

Today, we are announcing some major developments for NextView that mark the next chapter of our evolution. It’s hard to believe, but we started NextView back in 2011. Our 10-year anniversary occurred in the depths of the COVID pandemic, so instead of throwing a big party like we hoped, it was more of a moment for quiet reflection about the journey so far and where we want to take the firm next. Personally, I did a mini walkabout speaking to mentors and friends in the industry about various things like the future of tech, their take on the state of the venture capital business, and also about personal goals and motivations for our work.

While I walked away from that process with more questions than conclusions, our entire team has emerged from this period hyper-energized for the future. We continue to be committed to the core values of the firm, but also have a vision for how we want to practice our craft differently and with the ambition befitting the opportunity in front of us.

To this end, we are excited to announce two big developments for NextView.

The first is that we are welcoming Stephanie Palmeri as the newest Partner at the firm.

We are an equal partnership at NextView, so an addition like this is a huge step and commitment. Stephanie is someone that we have known for almost a decade and have respected deeply as a co-investor and collaborator at Uncork. We’ve coinvested with her, competed against her, and have shared wins and losses. Through all of this, what has been obvious is her hunger to serve founders and desire to work with entrepreneurs to bring about the kind of world changing impact we seek to be a part of at NextView.

Stephanie will continue to be based in San Francisco but will have a national scope for her investments much like the rest of the team at NextView. As someone who has seen multiple companies go from concept to $1B scale (and IPO), her experience and insight will be invaluable to the founders we work with. We are also excited to add another investor who has been a champion for greater access and representation in VC and entrepreneurship through her efforts as a founding member of AllRaise, as well as other initiatives.

Many of you reading this know Stephanie well and also know how lucky we are to have her join us. Please congratulate her on this next step in her career – we feel very blessed to be on this adventure together.

The second announcement is that we recently closed $200M of committed capital for NextView V and our first All Access Opportunity Fund.

While this is still quite small in the grand scheme of venture (and even quite modest among leading seed firms) this is a significant increase from the capital we raised for Nextview IV. Almost all of this increase came from our existing Limited Partners, with a small portion that was made available to new LPs.

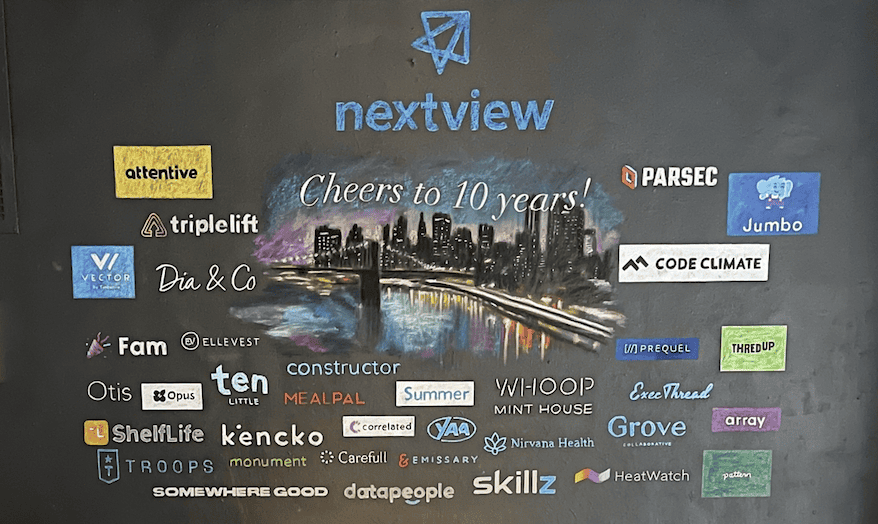

As always, we are grateful for the partnership of all of our Limited Partners who entrust us to be good stewards of their capital in both good markets and bad. While some of our prior funds are still quite early, we were able to take advantage of the attractive market conditions in 2021 to deliver significant liquidity back to our investors. This includes exits from the acquisitions and public offerings of companies like TripleLift, Skillz, Drift, ThredUp, Parsec and others, which allowed us to return multiples of several different funds. And even as the markets have turned, we continue to be confident that significant value creation is ahead for our portfolio companies that are still experiencing efficient hypergrowth like Attentive, Grove Collaborative, Whoop, Bobbie, Devoted Health, and others. The journey of VC investing is a long one, but we are grateful to have been able to deliver realized returns for our LPs and position the unrealized portion of our portfolios to thrive.

In terms of strategy, many things remain the same. We see the new fund and the addition of Stephanie as cementing what has become true about NextView over the past several years. Specifically:

We are high-conviction, hands-on lead investors

We make very few investments on a per-partner basis, which is why we are quite top-heavy as a firm. I don’t think there is another firm that has as many equal partners as we do relative to the size of our funds. This is intentional, so that we can serve founders better while also enjoying the breadth of portfolio and network effects that are valuable in this business.

We invest across the full spectrum of seed, but aren’t afraid to get involved dangerously early.

We have a model that allows us to be very flexible in how we engage with founders and co-investors. Many seed funds departed from pre-traction investing as they have scaled, but we have not. We write checks as small as $400K into pre-seed companies and as large as $4M and prefer to get involved before product/market fit. Of all the billion-dollar companies we have backed, 2/3 of our initial investments were pre-revenue, and many pre-product.

We deeply believe in boundless entrepreneurship

Meaning that the dynamism of entrepreneurial energy should not be held back by unnatural constraints. The potential of gifted founders to create lasting innovations transcends geography and background. VC-backed startups used to be an industry that was hyper-concentrated in a few clusters and dominated by very tight profiles of people. But this was always a significant market inefficiency, and one that we are committed to unraveling in the decade to come.

With Stephanie on board, we are now one of the very few bi-coastal seed funds in the industry, and all of the partners have led investments in NY, Boston, SF, and many other emerging ecosystems even before the pandemic. We have also strived to seek out and engage with founders of non-traditional backgrounds. We have a long way to go on this front, but we’ve been pleased that over the course of our fourth fund, over half of our portfolio is led by underrepresented founders, and 1/3 of the portfolio is led by female founders. Honestly though, we still feel like the top of our funnel is lacking in this dimension, and we have a lot of work yet to do on this front.

We continue to be focused on the digital redesign of the Everyday Economy

Finally, we continue to be focused on the digital redesign of the Everyday Economy. We focus on areas where we see broken end-user experiences that impact everyday people in the largest consumer and B2B markets. Some areas where we have focused recently include healthy living for seniors and kids, businesses that provide more seamless access to capital, products that help business end users more seamlessly access data, and companies that are modernizing the marketing and commerce stacks.

We have many other things in the works that we hope to bring to life over the next few years and hopefully the decade ahead. While we are energized and ambitious about the future, what I think Covid and this current market downturn have taught us is that we shouldn’t take for granted the opportunities of the moment. And so we embark on this new fund knowing that it’s a privilege to partner with founders and our LPs to do this work, and we will approach each day with our best effort.

Thank you for reading this. If you or someone you believe in deeply is building something that might be a fit for NextView please reach out to us. We’d love to see if we can partner together.

More on the news from Natasha Mascarenhas in TechCrunch here.