Fintech: the 21st-century assembly line

In my second blog post, I wanted to share a bit about myself and the intersection of two things that I am passionate about: cars and fintech startups.

As a kid, I was enamored with anything possessing an engine that could go fast (Fast and Furious is my favorite movie series 😅). My fantasy as a kid was to work at the Audi HQ in Stuttgart, Germany, designing and building my dream car.

This passion manifested itself in real life when I went to school at Northeastern to study Mechanical Engineering. However, I quickly realized that Engineering was more of a hobby, and I could use that very hobby to my advantage in the world of finance.

My freshman year, I entered and won a stock trading competition; my prize was a visit to the New York Stock Exchange. My initial expectations of a bustling floor with shouting traders came crashing down to reality when everything turned out to be an underwhelming TV set. I had heard of machines replacing humans, and this was my first of many times experiencing it in real life.

After graduation, I spent the next 9 years working at a bank, an early-stage b2b fintech startup, and a growth-stage mortgage startup. My first hand experience has helped me build a framework for go-to-market strategy (more specifically d2c marketing) and thinking about how to reach short term goals by constraining the factory.

So, despite not making my way to an auto factory like I originally dreamt about as a kid, I did find myself diving into the world of another type of factory, fintech startups.

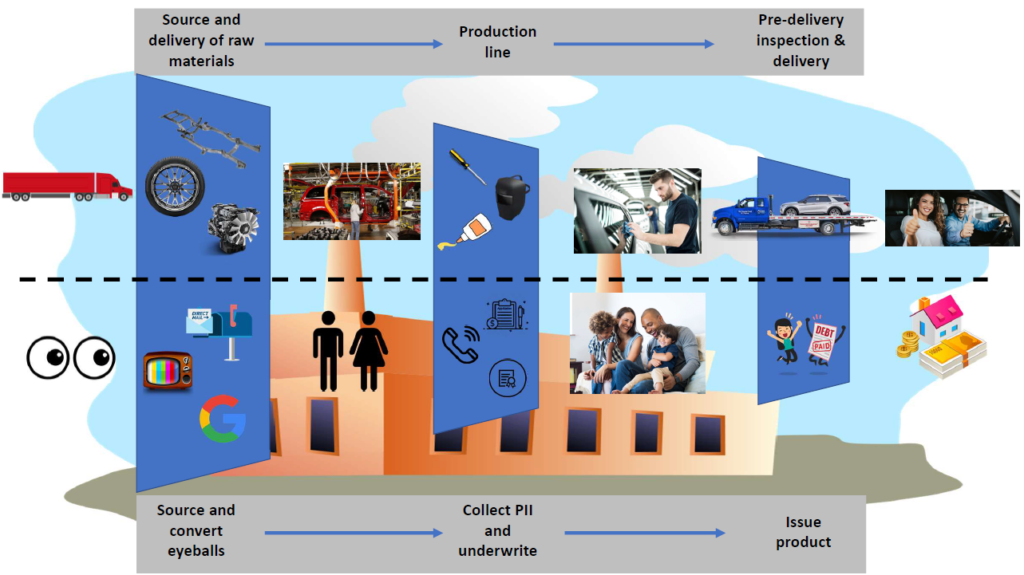

As an engineer, my brain solves problems by breaking them into digestible pieces. Most think of a fintech startup in terms of a funnel; a consumer enters the top and, through a mix of tech and human interaction, hopefully, makes their way to the bottom as a paying customer. I like to think of this funnel as a factory. 🏭

In other industries, customers may be able to skip milestones in a funnel. A fintech company has to work more like an assembly line because of the complexity and regulated nature of the products. The customer has to go through every step to get to the final milestone. You can’t install the wheels on a car before the chassis is assembled!

Take a direct-to-consumer fintech lender for healthcare workers, Plannery, as a more tangible example. Plannery’s initial product is a payroll-linked debt consolidation loan. Let’s see how a consumer moves through Plannery’s factory, similar to how a car is manufactured through an assembly line.

Sourcing and delivery of raw materials

First, raw materials need to be sourced and and delivered to the factory.

A set of eyeballs (health care provider) may see an ad, receive a piece of mail, or hear from a colleague that they can get out of debt faster. A call-to-action would coax them to visit the website to learn more. This person is not identifiable yet, so if they are interested in the loan, Plannery needs to make sure they are within the guardrails of their offering, which leads us to the next step in the assembly line.

Production line

Once the raw materials have been QC’d and prepared for assembly, the car travels along a moving production line as robots and humans work on it – weld, solder, screw, and glue parts to the frame. The fully assembled car will be cleaned and painted, and prepared for delivery.

Plannery collects personally identifiable information (PII) via an application. They check to make sure the customer is who they claim to be and evaluate the likelihood that the customer is a bad actor. A customer links their payroll provider and authorizes a credit pull. If the consumer meets the criteria and agrees to the conditions, the underwriting process will double-check that they are eligible and ultimately provide a rate and fees.

Pre-delivery inspection and delivery

A worker will inspect the car one last time to ensure all the systems are working. Once deemed safe and functioning, the vehicle is loaded back onto a truck and brought to a dealership to be sold!

The loan is originated, servicing set up, and existing debt is paid off. The customer saves money with a new, lower interest rate! 🥳 Plannery will deduct a portion of the consumer’s paycheck to pay back the loan, reducing the risk of a customer defaulting.

-Jack