Slack S-1: Will ARPU Drive Long Term Value?

Slack dropped their S-1 a couple weeks ago. Even before that, we all knew that it was among the most rapidly growing SaaS companies in recent years and a product used (and loved) by millions of people.

But now we have a chance to really dig in and understand Slack’s business a bit better. I have friends who are execs or shareholders of the company, but I have no stake in Slack nor intent to invest in the IPO. One of the key questions for me was how might Slack stack up against other great SaaS companies when it comes to average revenue per user (ARPU), and how ARPU and total addressable market (TAM) might drive Slack’s long run market cap.

If you haven’t seen these already, here are some of the headline figures about Slack’s business:

- $400M in GAAP revenue in the most recent year (fiscal year ’19 ended 1/31/19)

- Revenue growth rate of 82% year over year

- 10M+ daily active users (DAUs)

- Gross margins of nearly 90% (~87% in FY 2019)

A somewhat unique thing about the Slack IPO is that they’re pursuing a direct listing on the NYSE. So, similar to Spotify, their shares will simply begin trading publicly without having an underwritten “primary” offering of newly created shares that raises additional capital for the company. Practically speaking this doesn’t mean that all of the shares owned by founders, investors, employees (RSUs), or others will be available to trade immediately as they will need to be converted and registered for public trading. But it does mean that traditional 180 day lock-up periods won’t generally apply to existing Slack shareholders.

My interest in digging through Slack’s filing was to better understand the business. So the things I was trying to broadly analyze include:

- What are the current and future growth prospects for Slack?

- How well does Slack monetize each paid user, relative to other SaaS companies?

1) What are Slack’s growth prospects?

Slack remains a rapidly growing company even though they already have meaningful scale (>$500M annual billings). On a trailing basis they’re growing >80% YoY. So even though they’re less than doubling and growth is decelerating (as is typical for rapidly growing companies as they reach scale), Slack will conceivably hit $1B in GAAP revenue less than two years from now.

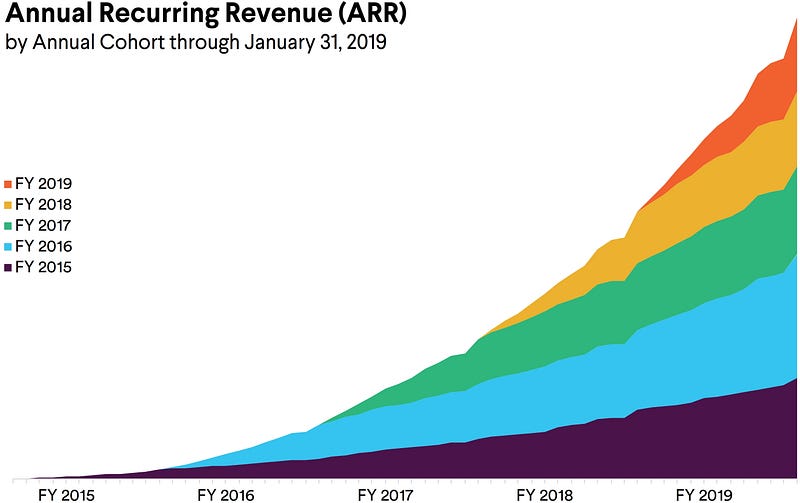

Below the headline figures you can see that a key driver of revenue growth is “expansion” revenue of existing customers spending more each year with Slack. This is presumably occurring as companies using Slack expand their usage across different workgroups, departments, or geographic locations. You can see this both by looking at a cohort “layer cake” graph or by examining the net dollar retention. Here’s the layer cake:

Growth and analytics types who work with cohort analyses will be very familiar with these, but for those who aren’t this chart basically shows how much recurring revenue Slack gets from customers who became paid subscribers in a given year. Charts with no axis labels or numbers infuriate me, but companies are entitled to present themselves however they wish when providing supplemental data like this. But just eyeballing it you can see that the incremental ARR from existing customers (FY15–18 cohorts) in 2019 is probably at least as much (if not more) than than the total ARR from new customers (those who started paying in 2019).

Slack’s net dollar retention rate is an incredibly impressive 143%. This is the mythical “negative churn” that recurring revenue businesses all strive for, whereby your existing customers (overall as a group) pay you more each year than they did the prior year even after accounting for those existing customers who left. So Slack generated $1.43 in MRR in 2019 from existing customers for every $1.00 in MRR from customers at the end of 2018. Slack’s net dollar retention rate is decreasing, but is still a long way from dropping below 100%. So it is reasonable to assume that Slack will continue generating more revenue from existing customers for the foreseeable future (e.g. next 3–5yrs at least, barring massive changes in customer behavior).

Bottom line… Slack appears primed to continue growing strongly from its existing customer base. In terms of penetrating new customers, it you believe Slack’s product has broad applicability for both small and large organizations across a breadth of industries and functions, it seems they’re a good distance away from market saturation. We can have a debate about TAM but at 10M DAUs, it seems there are still many millions of new users that may adopt Slack in the coming years.

2) How well does Slack monetize paid users?

Slack employs a freemium model, with <15% of the organizations using the product as paying customers (88K paid customers out of >600K organizations). But I believe one of the key determinants of Slack’s long run enterprise value will be the amount of revenue per user they ultimately generate.

Self-serve pricing ranges from $7–15/user/mo, but given enterprise pricing may involve volume discounts (lowering ARPU) as well as custom services and integration (increasing ARPU) we don’t know precisely how much revenue per paid user Slack generates. In their S-1 they disclose total active users (>10M DAUs) and total paid organizations (88K), but not the number of users in these paid customers. But it’s safe to assume that the largest organizations (in terms of users) are primarily paid orgs and the smallest ones are primarily free. We’ll talk more about segmentation in the next bit, but 40% of Slack’s revenue comes from roughly 600 large enterprise customers that pay >$100K/yr.

For the sake of discussion, I’m going to assume that about 40% of Slack’s DAUs are within paying customer orgs. Slack previously disclosed that it had 3M paid users out of 8M total in May last year, but paid users as a % of total had been trending upwards. So let’s call it 4M paid users who generated $400M of GAAP revenue in the most recent fiscal year. That works out to ~$100/user/yr in revenue.

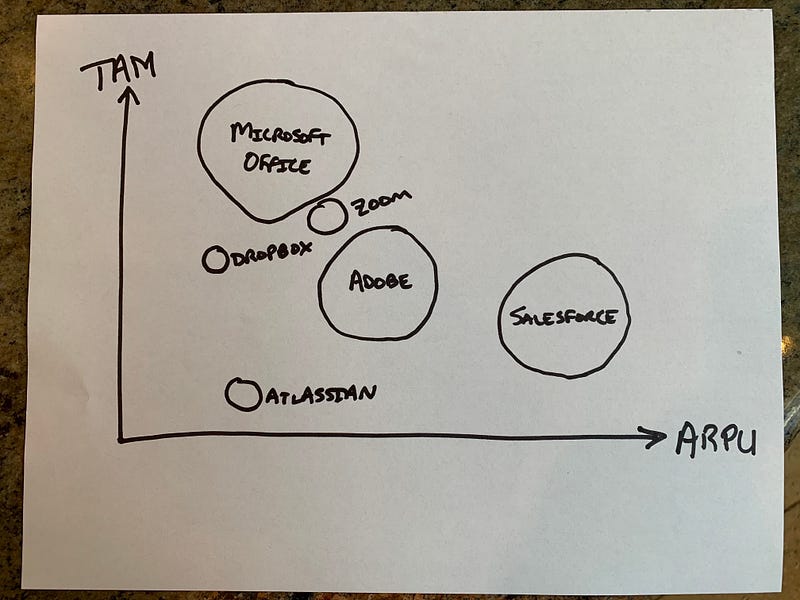

No two companies are a like, but we can draw analogies between Slack’s ARPU and other leading SaaS businesses. Also I’m making comparative judgements here between these companies to think about their long run scale, but all of them are very good businesses. The figures below are calculated or inferred from company reports, SEC filings, and public press announcements which disclosed revenue, customer, and user figures.

ARPUs/year

- Microsoft Office Commercial (non-consumer) = $180

- Salesforce = $2,200+

- Dropbox = $120

- Atlassian = $125

- Zoom = $180

- Adobe = $450+

Market Cap

- Salesforce = $121B

- Dropbox = $10B

- Atlassian = $28B

- Zoom = $20B

- Adobe = $137B

MS Office is obviously part of Microsoft overall which has many other huge businesses (Azure, Xbox, Windows, etc). But Office Commercial is a $24B a year revenue business on its own, and while a much older and more mature franchise than the others it’s still growing 25%+ annually. Also similar to Adobe, both Office 365 and Adobe’s Creative Cloud have pretty successfully transitioned from their legacy client software business models to SaaS. So it’s reasonable to assume that were it a standalone company, “Microsoft Office Co.” might have a market cap of $150B+.

To me, the question of whether Slack is a $20B market cap company or $50B or $100B+ in the long run is largely a function of ARPU and TAM. Public equity investors will measure it in the short term by the same metrics they judge other SaaS companies… multiples of revenue / EBITDA / bookings, growth rates, churn, sales efficiency, etc. But anyone contemplating a long term investment in Slack is implicitly making a bet on how many potential paid users there may be for Slack and how much revenue the company can extract from each one.

My very crude ARPU/TAM frontier sketch, size of circle is market cap

SaaS companies that become $50–100B+ market cap companies are either ubiquitous products like Microsoft Office which has 135M+ paying customers or they massively monetize certain segments the workforce but aren’t used as broadly. Salesforce and Adobe are unlikely have 100M+ paid customers for their core offerings, but they generate 4–10X more revenue per user than companies like Dropbox, Zoom, or Slack. Atlassian is a great business but interestingly has a modest ARPU but also a narrower TAM (software dev & IT professionals).

Bottom line, to believe that Slack could be a $50–100B+ market cap company in coming years you have to believe that it has a potential for ubiquity like Microsoft Office given it doesn’t monetize to the level that Adobe or Salesforce does (and seems unlikely to). I don’t think that’s a crazy bet or out of the realm of possibility btw… organizations that adopt Slack often consider it vital to their internal communication and workflow, and there’s a very broad range of orgs using Slack.