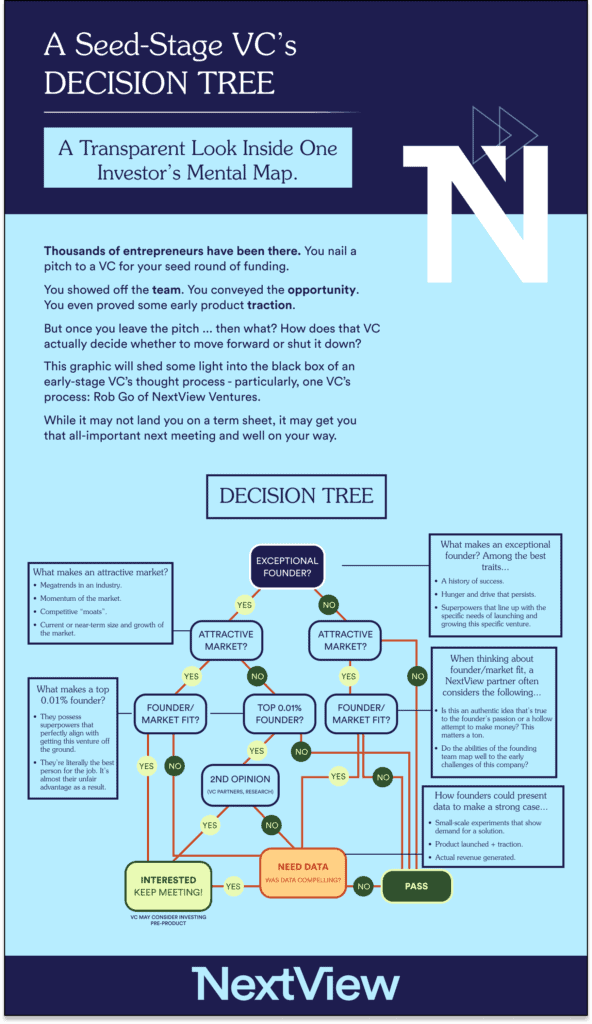

Flowchart: How a Seed VC Makes Investment Decisions

VC investment decision–making often feels like a black box to founders. You may feel like you had great rapport with an investor and nailed a pitch, only to have them quickly pass a few days later. Even worse, you may get ghosted and never hear back from the investor again, even after several follow-ups to that great meeting.

Other times, something seems to click and an investor gets genuinely engaged and drives towards a “yes”. What’s the difference between these two experiences for founders?

Different investors tend to approach their decision-making in different ways, but I’ve been reflecting on what my own process looks like. I’m not as structured as this post will make me out to be, but I tried to synthesize my own decision tree below. That is just the first couple steps in the process, but gives you a sense for what goes through my head. We tried to create a handy-dandy graphic to go along with it as well.

For very early-stage opportunities (pre-seed or early seeds) I tend to ask myself a few core questions:

- Is this an exceptional founder?

- Is this a market I want to invest in? This inquiry incorporates both the total size potential of the opportunity and the attractiveness of the market itself, as well as its resonance with me personally.

- Is there strong founder-market fit? In other words, are the unique super-powers of the founder well aligned with the specific challenges of building an early-stage business in this market? Are there reasons why this founder has and will continue to have unique insights to stay ahead of others in this space?

The answer to these questions tend to take us down different paths. A couple examples:

If I don’t know if a founder is exceptional, I might still take certain next steps if the market is very attractive and the entrepreneur clearly has founder/market fit. Spending more time together might convince me that the founder has lots of potential, or I might be willing to do more work to really listen closely to references for signs of potential excellence. You don’t need to be a repeat, successful entrepreneur to get VC’s to invest, but if you are building in an unattractive market or don’t have founder/market fit, it’s unlikely that an investor will do the work to really assess your potential.

If a founder seems excellent but she is building in an unattractive market, I tend to have a tough time getting to yes. Different investors have different perspectives here, but I’m of the “markets win” school of thought. That said, early-stage companies can pivot, so I know that however a founder is defining a market might evolve. In these situations, I tend to ask myself whether there are adjacent problem spaces that are substantial and whether the founder has a track record of being a “heat-seeking missile” to find the best opportunities. I also consider whether there is strong founder/market fit, because perhaps she just understands the dynamics of the space better than me, and can convince me that this market opportunity is actually more attractive than I think.

In multiple branches, I’m led to a spot where I just need some data. This may be when I’m not entirely sure about a founder, but the authenticity is there and the market seems interesting. Or, perhaps the founder is great, but the idea doesn’t seem to be a great fit for their strengths. In those cases, I might not be the right investor for a pre-seed, but could get there for the seed if there are some early signs of PMF.

In all of these paths, I think the frustration is whether an investor just doesn’t make some sort of a call. You will notice that there isn’t a question here around “who else is coming in” or “is this a hot deal”. Sadly, too many investors react to what others think about a company, and so it behooves them to slow roll an investment to maintain optionality. I think that most good investors do try to move with conviction, and have some mental model towards getting there.

Hope this was helpful. Here’s a visualization of my decision tree with some commentary on the different processes and nodes.